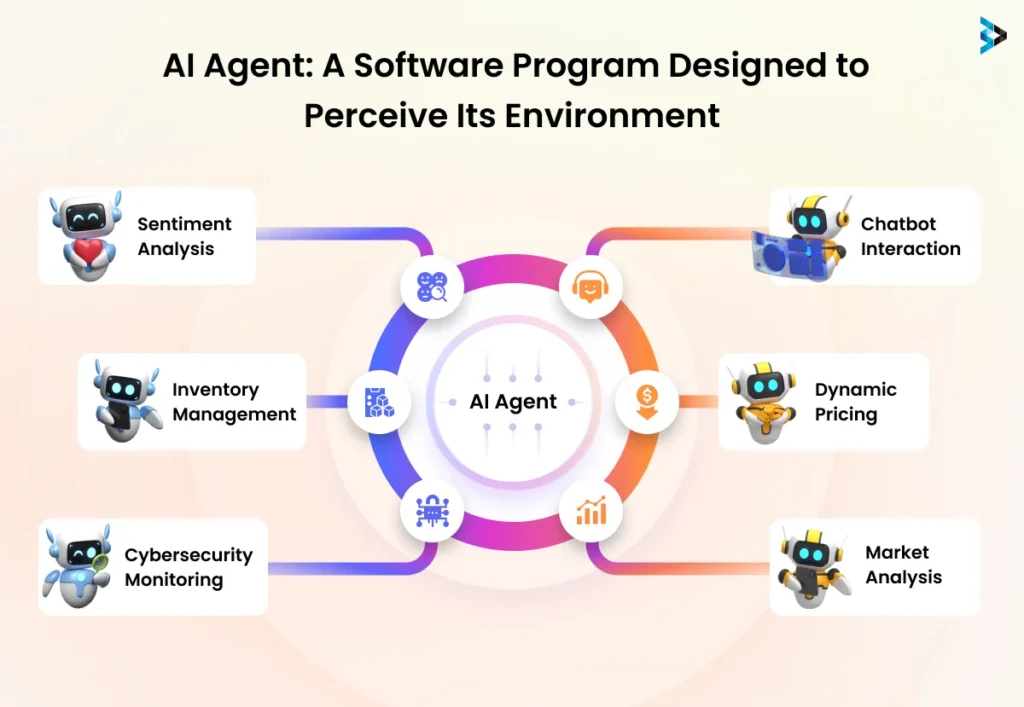

There are ten ways companies can improve their billing automation using AI agents.

1. Automated Invoice Generating

AI agents can generate invoices on their own by:

Extracting information from contracts, orders for purchase or sales transactions.

Create accurate invoices that include all the details and require only minimal manual intervention.

2. Dynamic Pricing, Adjustments and Prices

AI enables flexible billing models by:

Automating tiered, usage-based or subscription pricing models.

Applying discounts, promotions or adjustments dynamically, based on predefined rules.

3. Tax Compliance for Multi-Currency and International Taxes

AI simplifies international bill by:

Automatically converts currencies on the basis of the real-time exchange rate.

Calculate taxes according to local regulations, and ensure the compliance.

4. Recurring Billing Automation

AI handles subscriptions by:

Automating the billing cycle for weekly, month-to-month or annual plans.

Notifying customers or sending confirmations prior to the date of billing.

5. Real-Time Billing Validation

AI ensures billing accuracy through:

Verify the data to check for errors like incorrect numbers and double entries. Also, check for the absence of charges.

All anomalies must be flagged to be reviewed and corrected prior to the invoice is issued to the customer.

6. Faster Processing of Payments

AI can speed up payment workflows in:

Integration directly into payment gateways permits transactions to be processed instantly.

Customers can get automated receipts for payment and confirmations of payments.

7. Fraud detection and risk mitigation

AI ensures that payment processes are safe by:

Examining for patterns that are unusual in the billing information, for example, overinflated amounts or unauthorized changes.

The flagging of high-risk transactions to be investigated further. investigation.

8. seamless integration seamless integration ERP and CRM Systems

AI assists in data flow:

Connecting billing to ERP as well as CRM and accounting platforms.

Data synchronization in real-time is essential to ensure the consistency between systems.

9. Proactive Resolution of Billing Issues

AI improves Customer Experience by:

Automatically identifying billing issues. Examples include incorrect billing or payment not made.

Informing customers of any changes or disagreements.

10. Advanced Reporting and Analytics

AI can help you make better decisions making by:

Reporting in detail on the amount of revenue, efficiency of billing and outstanding balances.

Predictive analytics are available for predicting trends and maximizing cash flow.

AI agents help automate billing processes and improve accuracy. This allows businesses to reduce manual work, increase satisfaction with customers and provide more efficient financial operations. Follow the expert AI agent for Payment Status Update for website tips including AI agent for salary data validation, AI agent for liquidity planning, AI agent for self-service portal management, AI agent for supplier risk management, AI agent for finance, AI agent for procurement expense tracking, AI agent for finance, AI agent for cash management, AI agent for cash flow management, AI agent for hipaa compliance monitoring and more.

10 Ways Companies Can Utilize Ai Agents To Seamlessly Integrate With Existing Systems

These 10 tips will assist you in integrating AI agents seamlessly with your financial operations.

1. Automated Data Synchronization across Systems

AI agents are able keep data flowing smoothly if:

Automatic data synchronization between ERP/CRM systems, accounting systems, and banking systems.

Reducing manual data entry, and ensuring consistency on every platform.

2. Real-Time Transaction Processor

AI agents enable real-time process through:

Integration with banks, payment gateways, and financial platforms, to process transactions immediately.

The ability to update records in real-time across many systems, ensuring that the financial information is always current.

3. Cross-System Reconciliation

AI agents can reconcile financial data across various systems.

Automated integration of financial transactions among accounting, ERP and payment platforms.

Identifying discrepancies automatically and correcting them automatically and resolving.

4. Unified Reporting and Dashboards

AI agents can create unifying reports by:

The aggregation of data from all financial systems to create a single dashboard.

Offering real-time precise financial information and performance metrics to aid in decision-making.

5. Seamless integration of APIs

AI can integrate existing systems using APIs.

Application Programming Interfaces allow AI agents to connect with existing software.

AI agents can seamlessly transfer, retrieve and analyze data.

6. Workflow Automation between Platforms

AI agents can automate workflows using:

Automating processes like invoice making, approvals, payment, and integration of systems.

Improved efficiency and accuracy in financial operations by decreasing the manual involvement.

7. Intelligent Document Management

AI can handle documents across multiple systems:

Utilizing the Optical Character Recognition(OCR) and Natural Language Processing(NLP) for extracting and classifying data from invoices.

Data can be uploaded automatically into systems (e.g. document management software, accounting software) for storage.

8. AI-driven Customer Relationship Management

AI can integrate with CRM by:

Utilizing customer information from financial systems to offer specific financial products or advice.

Automatically updating customer records with information about payment history, transaction history and other information derived from AI analysis.

9. Fraud Detection Across Financial Systems

AI enhances fraud detection by:

Continuously analyzing transaction data across integrated financial platforms to identify irregularities.

Alerting all relevant stakeholders in real-time of the possibility of fraudulent activity on the systems.

10. Predictive Analytics Integration

AI integrates with Financial Forecasting Tools:

Predicting cash flow, revenue and expenditure by analyzing data from accounting systems, sales and payment systems.

To improve the accuracy of forecasting, you can feed this information into your financial planning software.

Businesses can increase operational efficiency, improve accuracy and improve workflow efficiency by leveraging AI agents that seamlessly integrate with financial systems. Read the recommended AI agent for Cash Management for website examples including AI agent for invoice adjustment, AI agent for contract compliance, AI agent for it security, AI agent for investment strategy, AI agent for legal compliance, AI agent for accounts receivable, AI agent for vendor data validation, AI agent for consumer insights, AI agent for customer service, AI agent for legal and more.

Ai Agents Can Assist Businesses Adhere To Regulations And Ensure Compliance.

Here are 10 ways AI agents assist companies in complying with financial regulations.

1. Automating Regulatory Compliance

AI agents can simplify the reporting process through:

Automatically generate compliance reports that are required by regulatory agencies (e.g. SEC filings or tax reports).

By ensuring all documents required are promptly filed and in a timely manner, the possibility of paying fines for late filings or non-compliance decreases.

2. Monitoring Transactions in Real-Time

AI ensures compliance with anti-money laundering (AML) as well as Know-Your-Customer (KYC) through:

Continuously monitoring transactions in the financial system to detect suspicious activities.

Flagging transactions which may be in violation of compliance regulations such as large or irregular payments or cross-border transactions requiring additional examination.

3. Automated audits, data validation and verification

AI agents assist in audits by:

Automated checks are used to verify that the financial records and transactions conform to internal policies and guidelines.

Verifying the completeness and accuracy of financial information and alerting you to any errors or inconsistencies that could result in compliance issues.

4. Monitoring the Data Security and Privacy

AI can help meet data protection regulations (e.g., GDPR) by:

Securely encrypting sensitive transaction and customer data to ensure it is securely stored and transmitted.

Automatically managing consent preferences and ensuring that the customer's personal data are only used in accordance with legal agreements.

5. AI-powered Fraud detection

AI assists in preventing fraud:

Monitor transaction patterns constantly for irregularities and fraudulent activities that may be in breach of the rules of finance.

Machine learning algorithms can help predict and spot potential fraud risks. This reduces the likelihood of a violation of financial or legal standards.

6. Changes to the Regulatory Framework

AI can help business stay up to date by:

Be aware of changes to financial regulations, such as taxes and reporting requirements.

Update internal systems and processes regularly in order to make sure that they are compliant with latest regulatory updates.

7. KYC (Know Your Customer or Know Your Customer) and AML Compliance

AI aids in compliance through:

Automating the customer identification and verification procedure, ensuring that companies adhere to KYC requirements.

Examining customer data to identify possible money laundering activities by comparing their behaviors to known risk profiles.

8. Risk Assessment and management

AI can help improve risk management for compliance.

The assessment and prediction of the risk of compliance continuously by analyzing historical data such as financial transactions, external factors, etc.

Recommending actions to reduce the risk identified and ensure conformity with the regulations.

9. Document and Contract Analysis

AI improves compliance in these ways:

Reviewing agreements, contracts or any other legal document to confirm the compliance with regulations.

In assisting businesses to avoid violating legal requirements by automatically flagging clauses that could be in conflict with them.

10. Tax Compliance Technology

AI reduces the tax compliance process by:

Automating the calculation of tax and filing them, ensures that businesses adhere to tax laws and deadlines.

Reviewing transaction information to discover deductions, exemptions, and other tax-related opportunities while being careful to avoid errors which could result in penalties.

Utilizing AI agents to assist in these areas, companies can ensure strict conformity with regulations, minimize the chance of mistakes or omissions, and stay ahead of regulatory changes. AI's ability to automate, track, and adapt to evolving requirements is an essential instrument to ensure compliance with regulatory requirements for financial operations. See the best AI agent for Invoice Matching for site info including AI agent for policy adherence, AI agent for complAInt resolution tracking, AI agent for withholding tax compliance, AI agent for litigation support, AI agent for clause analysis, AI agent for subscription renewal, AI agent for self-service portal management, AI agent for help desk support, AI agent for invoice management, AI agent for knowledge base management and more.